Adam Lebor wrote Tower of Basel: The Shadowy History of the Secret Bank that Runs the World in 2013.

Adam Lebor’s book is the first critical investigative history of the most secretive and powerful global financial institution in the world. Lebor conducted many interviews of international central bankers and their employees, including Paul Volcker, the former chairman of the Federal Reserve Bank (the Fed), and Sir Mervyn King, former governor of the Bank of England. He also conducted extensive archival research of the Bank for International Settlements (BIS) in Basel, Switzerland and other libraries in the United States and Great Britain. His book includes biographies on the major central bankers who founded the bank and the important officials who worked at the BIS.

The sordid history of the Bank for International Settlements (BIS)

The Bank for International Settlements was created on May 17, 1930 to administer or “settle” the World War I reparations imposed on Germany under the Treaty of Versailles. There were four very powerful individuals who played a very important role in the founding of BIS. They were Charles Gates Dawes, Owen Daniel Young, Hjalmar Schacht, and Montagu Norman.

President Calvin Coolidge is shown on the left in the picture and on the right is Vice President Charles Gates Dawes.

The first of these individuals was Charles Dawes. He was born on August 27, 1865 and died on April 23, 1951. Dawes was a powerful banker, politician, and military general. Charles G. Dawes was the director of the United States Bureau of the Budget in 1921 and later served on the Allied Reparation Commission in 1923. He subsequently worked on stabilizing the German economy. For his work on the Dawes Plan for Germany’s World War I reparations, he won the Nobel Peace Prize in 1925.

Charles Dawes was elected vice president under President Calvin Coolidge from 1925 to 1929. Two years later, he was appointed ambassador to England. In 1932, Dawes resumed his banking career as chairman of the board of the City National Bank and Trust in Chicago, where he remained until his death in 1951.

Owen D. Young

The other American who founded the BIS was Owen D. Young. He was born on October 27, 1874 and died on July 11, 1962. Young served as a member of the German Reparations International Commission during the Second Reparations Conference in 1929.

In addition to his work on the German Reparations Commission, Young founded the Radio Corporation of America (RCA) as a subsidiary of General Electric in 1919. Young was appointed as first chairman of RCA and continued in this position until 1933. Owen D. Young was chairman of the board of General Electric from 1922 to 1939. He tried to obtain the nomination as president of the Democratic Party but lost to Franklin Delano Roosevelt in 1932.

German Hjalmar Schacht was one of the founders of the BIS.

The third powerful banker who founded the BIS was Hjalmar Schacht. He was born on January 22, 1877 and died on June 3, 1970. He was a German economist, banker, politician, and co-founder in of the German Democratic Party in 1918. He served as the Currency Commissioner and President of the Reichsbank under the Weimar Republic. He was a fierce critic of his country’s post-World War I reparation obligations. Schacht became a supporter of the bloody dictator Adolf Hitler.

Schacht served in Hitler’s regime as President of the Reichsbank from 1933 to 1939 and Minister of Economics from 1934 to 1937. He was responsible for the economic recovery of Germany that allowed Adolf Hitler to rearm the German Armed Forces and lounge World War II.

Schacht opposed Hitler’s policy for the re-armament of Germany due to its violation of the Treaty of Versailles and because he believed that it disrupted the German economy. He was dismissed as President of the Reichsbank in January 1939. Hjalmar Schacht remained as a minister without portfolio and received the same salary until he was fully dismissed from the government in January 1943. After the war, he was tried at Nuremberg but acquitted.

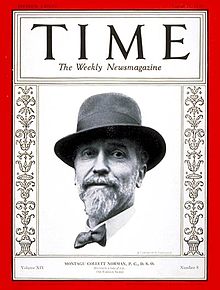

British Montagu Norman was one of the founders of the BIS.

The fourth powerful banker who founded the BIS was Montagu Norman. He was born on September 6, 1871 and died on February 4, 1950. He served as Governor of the Bank of England from 1920 to 1944. During those years, he was one of the most influential central bankers of the world. His power was so enormous that a single speech made by Norman could affect the New York Stock Exchange in the United States and other stock exchanges in the world. Before and during World War II, Montagu Norman’s allegiance was to the Bank of International Settlements and not to Great Britain.

In addition to Adam Lebor outstanding book, Tower of Basel: The Shadowy History of the Secret Bank that Runs the World (2013), other books have been written on the operations of the Bank of International Settlements. James C. Baker is the author of a pro-BIS book entitled The Bank for International Settlements: Evolution and Evaluation (2002). Baker wrote a comprehensive history of BIS.

James C. Baker wrote the book The Bank for International Settlements: Evolution and Evaluation, in 2002.

Amazon described this book as follows: “In a world of increasing cross-border financial transactions, the Bank for International Settlements stands out as the oldest existing international financial institution and among the most controversial. For many it is a mystery: What does it actually do? For others it poses an ethical dilemma: What did it do to aid the Nazis during World War II? Baker examines the history, administration, evolution, and operations of this reclusive institution. He discusses the work of its permanent committees, such as the Basel Concordats of 1975 and 1983 and the Basel Capital Accords of 1988 and 2001.”

“Among other products and services he notes the BIS’s studies of the use of derivatives by banks, its analysis of payment and settlement systems worldwide, and its supervision of the insurance and investment banking businesses. Then, in a cool and balanced appraisal, he looks at the Bank’s operations during World War II, its relationship with the Nazis in their gold and foreign exchange transactions. Throughout, he underlines the importance of the BIS and its value in maintaining stability of the international monetary system. The result is a major academic study, a work of special interest to scholars, teachers, and students, and an important, readable, engrossing account for finance and investment professionals as well.”

Kazuhiko Yago wrote the book The Financial History of the Bank for International Settlements in 2012.

Another book on the BIS was written by a Japanese scholar. A review of Kazuhiko Yago book, The Financial History of the Bank for International Settlements (2012), by Financial History Review said the following: “One of the most ‘Europeanised’ Japanese scholars, benefited from a grant which helped him delve into the archives of the Bank for International Settlements (organized by Piet Clement) and of a few central banks. His book does not compete with Gianni Toniolo’s overall history commissioned by the BIS … or with the papers delivered by either Toniolo or Clement. Nevertheless, it makes a contribution to the construction of the history of the BIS and to that of the cooperation between central banks, in Europe and across the Atlantic, and its bibliography, collected in the endnotes, serves as a toolkit.”

Amazon described Yago’s book as follows: “The Bank for International Settlements (BIS), founded in 1930, works as the Bank for Central Banks. The BIS is an international forum where central bankers and officials gather to cope with international financial issues, and a bank which invests the funds of the member countries. This book is a historical study on the BIS, from its foundation to the 1970s. Using archival sources of the Bank and financial institutions of the member countries, this book aims to clarify how the BIS faced the challenges of contemporary international financial system.”

“The book deals with following subjects: Why and how the BIS has been founded? How did the BIS cope with the Great Depression in the 1930s? Was the BIS responsible for the looted gold incident during WWII? After the dissolution sentence at the Bretton Woods Conference in 1944, how did the BIS survive? How did the BIS act during the dollar crisis in the 1960s and the 1970s? A thorough analysis of the balance sheets supports the archival investigation on the above issues.”

“The BIS has been, and is still an institution which proposes an alternative views: crisis manager under the Great Depression of the 1930s, peace feeler during the WWII, market friendly bank in the golden age of the Keynesian interventionism, and crisis fighter during the recent world financial turmoil. Harmonizing the methodology of economic history, international finances and history of economic thoughts, the book traces the past events to the current world economy under financial crisis.”

Gianni Toniolo wrote with Piet Clement the book Central Bank Corporation at the Bank for International Settlements 1932-1973 in 2005.

Another book on the BIS was written by Gianni Toniolo with Piet Clement Central Bank Corporation at the Bank for International Settlements 1932-1973 (2005). These two professors wrote the history of the BIS from 1932 to 1973.

Geoffrey Wood reviewed Central Bank Corporation at the Bank for International Settlements 1932 to 1973 (2005) for the EH:NET website and expressed the following:

“This book covers the history of the Bank of International Settlements (BIS) from its birth in 1930 to 1973, a date determined by the thirty year rule. There is, before the historical study proper starts, a fascinating opening chapter which very briefly describes international monetary systems between 1870 and 1973, discusses what central bank cooperation can mean, and reviews that cooperation under the classical gold standard and for the years 1914 to 1922, as well as setting out A BIS View of Cooperation. Let it be said immediately that this is a useful and interesting book. It is also very detailed, and, except for the specialist, for dipping into rather than cover to cover reading… What would a reader of it learn? It is in twelve chapters, ordered, after the first, chronologically, the breaks determined by key events such as exchange rate regime changes. There are also five appendices, and, absolutely essential to understanding, a list of acronyms – of which there are many.”

“The chapters deal with the planning for and birth of the BIS; its organization; and then into rough waters, with 1931. The next three chapters cover the discussions after the collapse of the international gold standard; actions between the end of gold and the start of war; and wartime. Then of course comes Bretton Woods and its long aftermath –multilateral payments, convertibility, and the “Patching Up” (Toniolo’s apt phrase) of the 1960s. Finally comes monetary union and the move of the BIS into being concerned with financial stability.”

“There is something, then, for almost everyone with an interest in monetary or international financial, history. The book is plainly comprehensive. Is it good? Obviously, Toniolo’s reputation leads one to expect so — but a check is always useful, and I first carried out that check by looking at chapter five, which is on a period on which I have worked fairly recently, and at chapter one, where the issue of defining cooperation is considered.”

“As that strikes me as not altogether straightforward I wanted to see what Toniolo made of it…I learned much from the chapter on the BIS in wartime; I encountered material completely new to me in the account of how the BIS survived Bretton Woods; and, in chapter 10 started to achieve, I think, a grasp of the tangled and vague notion of convertibility. There was no chapter from which I did not learn something, and that holds even for chapter 12, which covers “Monetary Union and Financial Stability.” Both of these topics, European monetary union, in particular the Werner plan, and the stability implications of Eurocurrency markets, are areas where I have been involved both as a researcher and as a worker on policy, and even here I learned — not only some fresh perspectives, but also facts new to me…We should all be grateful to Toniolo for by his efforts providing us with the material to address a large number of important questions, and for embedding that material in a useful and informative historical narrative.”

Carl Teichrib contributed to an article or report entitled “Global Banking: The Bank for International Settlements” prepared by The August Forecast and Review, which was published on October 14, 2005. The article presented a comprehensive history of the creation of the BIS and a short biography of the founders and history of BIS up to 2005. Edward Jay Epstein wrote an article about the BIS in Harpers Magazine in 1983. He described the BIS as the “most exclusive, secretive, and powerful supranational club in the world.”

This photo was taken by Haydée Prado de Varona, who is the wife of this writer, during their visit to Basel, Switzerland on July 19, 2017. The building was constructed in 1977. It is an 18-story circular skyscraper that rises over the city of Basel, Switzerland. This is the main building of Bank for International Settlements and is called the Tower of Basel.

In spite of the books and many articles that have been published, the BIS is completely unknown by the vast majority of Americans and people around the world. On July 19, 2017, during this author’s visit to the beautiful city of Basel, Switzerland, which is the location of BIS, he spoke to a well-informed tourist guide from that city and she had no idea of the role of international central bankers and their employees at the BIS.

This photo was taken by Haydée Prado de Varona, who is the wife of this writer, during their visit to Basel, Switzerland on July 19, 2017. This is another building with a round shape of the Bank for International Settlements.

This most powerful supranational bank has always wanted to keep a low profile. Even well-known authors who have written books describing the history of the operations of the Federal Reserve Bank as well as the powerful organizations that run the United States and the world, such as the Bilderberg Group, the Trilateral Commission, and the Council of Foreign Relations, do not mention the existence of the BIS. This is surprising as the owners and employees of the banking cartels, who own the central banks of almost all the Western nations, including the United States, are all involved with the BIS. This international bank is the central bank of all the central banks in the United States and Europe, as well as in other nations in the world.

The Hague Agreement of 1930 that created the Bank for International Settlements

On January 20, 1930, the governments of the United Kingdom, Germany, France, Belgium, Italy, Japan, and Switzerland signed a document that became known as the Hague Agreement. Article 1 of the Hague Convention or Agreement stated that “Switzerland undertakes to grant to the Bank for International Settlements, without delay, the following Constituent Charter having force of law: not to abrogate the Charter, not to amend or add to it, and not to sanction amendments to be Statutes of the Bank referred to in Paragraph 4 of the Charter or otherwise than in agreement with the other signatory governments.”

Article 10 of the Hague Convention or Agreement stated that “the bank, its property and assets and all deposits and other funds entrusted to it shall be immune in time of peace and in time of war from any measure such as expropriation, requisition, seizure, confiscation, prohibition or restriction of gold or currency export or import, and any other similar measures.” Thus, the powerful BIS was born as a result of this international treaty.

According to Adam Lebor, Gianni Toniolo with Piet Clement, and James C. Baker, authors of books regarding the history of the Bank for International Settlements, this supranational banking institution was created with unprecedented powers and privileges. The central bankers who created the BIS held politicians with contempt, the exception being if the politician was one of their own.

The BIS founders wanted to build a transnational financial system that could move large amounts of capital free from political or governmental control. The central bankers demanded and received incredible immunity from their own governments, free from any type of regulation, scrutiny, or accountability for the BIS directors and members as well as their employees.

The unprecedented immunity that was granted was the following:

- Diplomatic immunity for persons and what they carry with them, such as diplomatic pouches.

- Not being subjected to taxation on any transactions, including salaries paid to employees.

- Embassy-type immunity for all buildings and/or offices operated by the BIS.

- Freedom from immigration restrictions.

- Freedom to encrypt any and all communications of any sort.

- Freedom from any legal jurisdiction.

- Immunity from arrest or imprisonment and immunity from seizure of their personal baggage, except in flagrant cases of criminal offense.

- Immunity from jurisdiction, even after their mission has been accomplished, for acts carried out in the discharge of their duties, including words spoken and writings.

- Exemption for themselves, their spouses, and children from any immigration restrictions, from any formalities concerning the registration of aliens, and from any obligation relating to national service in Switzerland.

- The right to use codes in an official communications or receive or send documents or correspondence by means of couriers or diplomatic backs.

On February 10, 1987, the BIS and the Swiss Federal Counsel signed a “Headquarters Agreement” which confirmed the immunities previously granted to the BIS when it was created, as well as additional immunities. Article 2 stated that “the Bank buildings shall be inviolable… No agent of the Swiss public authorities may enter therein without the express consent of the Bank… The archives of the bank and, in general, all documents and any data media belonging to the Bank… shall be inviolable at all times and in all places. The Bank shall exercise supervision of an police power over its premises.”

Article 4 of the Headquarters Agreement stated the following: “The Bank shall enjoy immunity from criminal and administrative jurisdiction, except to the extent that such immunity is formerly waived in individual cases by the president, the general manager of the Bank, or their duly authorized representative. The assets of the Bank may be subject to measures of compulsory execution for enforcing monetary claims. On the other hand, all deposits entrusted to the Bank, all claims against the Bank and the shares issued by the Bank shall, without the prior agreement of the Bank, be immune from seizure or other measures of compulsory execution and the sequestration, particularly of attachment within the meaning of Swiss law.” In essence, the 1987 Headquarters Agreement granted the BIS similar protections given to the headquarters of the United Nations, the International Monetary Fund, and diplomatic embassies.

On February 27, 1930, the governors of the central banks of Germany, Great Britain, France, Italy, and Belgian met with representatives from Japan and three American banks to establish the Bank for International Settlements. Each nation’s central bank purchased 16,000 shares. Since the Federal Reserve Bank was not permitted to own shares of the BIS for political reasons, three United States banks, the First National Bank of New York, J. P. Morgan, and the First National Bank of Chicago, created a consortium and each bank purchased 16,000 BIS shares. Thus, the United States representation at the BIS was three times as that of any other nation.

This international bank’s initial share capital was set at 500 million Swiss francs. The owners of the BIS purchased 200,000 shares of 2,500 of gold francs. The governors of the founding central banks were ex-officio members of the board of directors and each could appoint a second director of the same nationality.

Many years later, on January 8, 2001, an Extraordinary General Meeting of the BIS approved a proposal that restricted ownership of the BIS shares to central banks. At the time, 13.7% of all shares were in private hands. The BIS set a price of $10,000 per share which was over twice the book value of $4,850. Some private owners of the BIS shares filed a lawsuit against the bank insisting that the shares were worth much more money than what was offered.

At the beginning, central bankers wanted to keep a very low profile and complete anonymity for their activities. The first headquarters of the BIS was an abandoned six-story hotel, the Grand et Savoy Hotel Universe, with an address above the adjacent Frey’s Chocolate Shop, near the train station at Basel, Switzerland. No sign was placed at the door identifying the BIS.

In May 1977, however, the BIS moved to a more visible and efficient headquarters. The new building was an 18-story circular skyscraper that arises over the medieval city of Basel, Switzerland and soon it became known as the “Tower of Basel.” The new building is completely air-conditioned and self-contained. It has a nuclear bomb shelter in the basement, a private hospital, and some 20 miles of subterranean archives. From the top floor of the Tower of Base there is a panoramic view of Germany, France, and Switzerland.

The shameful conduct of the Bank for International Settlements during World War II

During World War II the BIS continued operating from its headquarters in Basel, Switzerland. Adam Lebor explained that “during the war, the BIS became a de-facto arm of the German Reichsbank, accepting looted Nazi gold and carrying out foreign exchange deals for Nazi Germany.” The alliance of the BIS with Germany was known in the United States and Great Britain. However, the need for the bank to keep functioning in order to maintain transnational financial operations was agreed by all the countries that fought each other during World War II.

Thomas McKittrick was president of the Bank for International Settlements during World War II.

Thomas Harrington McKittrick was born in 1889 and died in 1970. He was an American banker and president of the Bank for International Settlements during World War II whose close relationship with Hitler’s Third Reich created a great deal of controversy.

McKittrick joined the National City Bank in 1916. Later, he assisted in opening a branch of the bank in Genoa, Switzerland. McKittrick was president of the Bank for International Settlements from 1940 to June 1943, under the chairmanship of Otto Niemeyer and Ernst Weber. The BIS, which intended to facilitate effective monetary co-operation, declared its neutrality in World War II. After the war was declared in September 1939, it was no longer possible for representatives of Germany, France, or the United Kingdom to attend the BIS meetings. Due to the commencement of hostilities in France, only a few miles from the BIS headquarters in Basel, Switzerland, McKittrick was the only member of its assembly to attend the May 1940 meeting.

Thomas McKittrick was a family friend of another globalist Allen Dulles, a U.S. intelligence officer also based in Switzerland during World War II. Dulles later became a Director of the Central Intelligence Agency. Dulles was the CIA Director when he and other globalists in the Kennedy administration were responsible for the failure of brave Cuban patriots who fought at the Bay of Pigs in 1961 to liberate Cuba from communism.

During World War II, the BIS received gold as interest payments from the German Reichstag, which later investigations showed had been looted from the central banks of Belgium, the Netherlands and other nations conquered by Nazi Germany. From 1946 to 1954, McKittrick worked for the globalist Chase National Bank, becoming a senior vice president and director.

Lebor pointed out the following: “A few miles away, Nazi and Allied soldiers were fighting and dying. None of that mattered at the BIS. Board meetings were suspended, but relations between the BIS staff of the belligerent nations remained cordial, professional, and productive. Nationalities were irrelevant. The overriding loyalty was to international finance.” During the war years, an American, Thomas McKittrick, was president of the bank. A Frenchman, Roger Auboin, was the general manager and a German, Paul Hechler, was the assistant general manager and a member of the Nazi party. An Italian, Raffaelle Pilotti, was the Secretary-General; a Swedish, Per Jacobssen, was the Bank’s economic advisor; and other employees were British.

Four of the five Nazi directors of the BIS were convicted of war crimes

Since the time that Adolf Hitler came to power in Germany in 1933 and to the end of World War II in 1945, five German members of the board of directors of the BIS were Nazis. After World War II four of them were convicted of war crimes. These BIS directors were the following:

Hjalmar Schacht was the architect of the economic recovery of Germany and served as President of Reichsbank until 1939. He was one of the four individuals who founded the BIS, as explained earlier. After the war, he was tried at Nuremberg but acquitted. In 1953, he founded a private banking house in Düsseldorf.

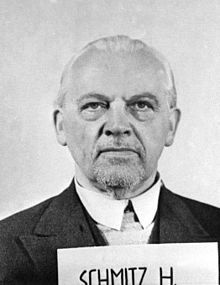

This picture of Hermann Schmitz was taken after his arrest by the U.S. Army.

Hermann Schmitz was born on January 1, 1881 and died on October 8, 1960. He was a German industrialist and Nazi war criminal. In 1941, Hitler gave him a portrait of him with his autograph as a gift for his dedication to the aims of Nazi Germany. He was sentenced to four years in prison for war crimes and crimes against humanity through the plundering and spoliation of occupied territories.

Hermann Schmitz was the Chief Executive Officer of IG Farben from 1935 to 1945, a gigantic German chemical conglomerate that during the war built and ran a factory of synthetic rubber using prisoners as slave laborers at the concentration camp at Auschwitz. He was released in 1950 and went on to become member of the administrators’ council of Deutsche Bank in Berlin, as well as the honorary president of Rheinische Stahlwerke AG.

Walther Funk

Walther Funk was born on August 18, 1890 and died on May 31, 1960. He was an economist and prominent Nazi official who joined the Nazi party in 1931. Funk replaced Hjalmar Schacht at the Reichsbank. Funk worked for the SS Chief Heinrich Himmler, who was one of the most powerful men in Nazi Germany and one of the people most directly responsible for the Holocaust.

Funk was tried and convicted as a major war criminal by the International Military Tribunal at Nuremberg and sentenced to life in prison. At the Nuremberg trials American Chief Prosecutor Jackson labeled Funk as “The Banker of Gold Teeth,” referring to the practice of extracting gold teeth from Nazi concentration camp victims, and forwarding the teeth to the Reichsbank for melting down to yield bullion. Many other gold items were stolen from victims, such as jewelry, eyeglasses, and gold finger rings.

As Minister of Economics, Funk accelerated the pace of rearmament and, as Reichsbank president, banked for the SS the gold rings of Nazi concentration camp victims. Funk was held at Spandau Prison along with other senior Nazis. He was released on May 16, 1957 because of poor health. Walther Funk died three years later in Düsseldorf of diabetes.

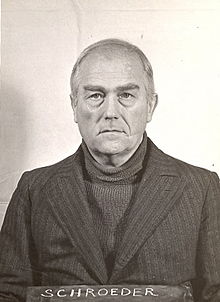

This picture of Baron Kurt Freiherr von Schröder was taken at the Nuremberg Trials.

Kurt Freiherr von Schröder was born on November 24, 1889 and died on November 4, 1966. He was a German nobleman, financier, and SS-Brigadeführer. Baron Kurt von Schröder was the owner of the J.H.Stein Bank, a bank that held the deposits of the Gestapo. After World War II Schröder was arrested and was tried by a German court for crimes against humanity. He was found guilty and was sentenced to three months’ imprisonment.

Emil Puhl is standing on the left in the picture.

Emil Johann Rudolf Puhl was born on August 28, 1889 and died on March 30, 1962. Puhl was a Nazi and director and vice-president of Germany’s Reichsbank during World War II. Similar to Walther Funk, Puhl send gold stolen from countries occupied by the Nazis and gold stolen from their victims incarcerated in Nazi concentration camps. Much came from the victims of Operation Reinhard at Auschwitz, Majdanek, Treblinka, Bełżec, Chełmno, and Sobibór. After prisoners were mass murder by gas, their property was removed. Puhl was convicted of war crimes and sentenced to five-years imprisonment

During the Nuremberg trials that followed the end of World War II, 104 Germans were sentenced to death or to prison terms. Those who received terms in prison included four of the five German Nazi directors of the BIS.

The proposal to liquidate the BIS during the Bretton Woods conference in 1944 was reversed in 1948

After the war during the Bretton Woods conference held in New Hampshire in July 1944, Norway proposed the liquidation of the BIS at the earliest possible moment for assisting Nazi Germany to deposit the stolen gold from the occupied nations that it had conquered in the bank. The liquidation of the bank was supported by other European delegates as well as the United States delegates, who included Harry Dexter White and the Secretary of the Treasury Henry Morgenthau. However, the liquidation of the bank was never actually undertaken. In April 1945, the new United States President Harry S. Truman and the British government suspended the dissolution of the bank. The decision to liquidate the BIS was officially reversed in 1948.

How does the Bank of International Settlements operate today?

Jaime Carauna from Spain has been the BIS General Manager since April 1, 2009.

The BIS is a bank for all the central banks of the major nations in the world. According to the website of the Bank for International Settlements, the mission for this international bank is to serve central banks in their pursuit of monetary and financial stability, foster international cooperation in those areas, and act as a bank for central banks. The BIS pursues its mission by:

- Promoting discussion and facilitating collaboration among central banks.

- Supporting dialogue with other authorities that are responsible for promoting financial stability.

- Conducting research on policy issues confronting central banks and financial supervisory authorities.

- Acting as a prime counterparty for central banks in their financial transactions.

- Serving as an agent or trustee in connection with international financial operations.

The BIS is owned by 60 member central banks, representing countries from around the world that together make up about 95% of world GDP. Its head office is in Basel, Switzerland and it has two representative offices: in the Hong Kong Special Administrative Region of the People’s Republic of China and in Mexico City.

Acting as the central bank, the BIS has sweeping powers to do things for its own benefit or to assist one of its member’s central banks. Article 21 of the original BIS statute defines the day-to-day operations as follows:

- Buying and selling of gold coin or bullion for its own account or for the account of central banks;

- Holding gold for its own account under reserve in central banks;

- Accepting the supervision of gold for the account of central banks;

- Making advances to or borrowing from central banks against gold, bills of exchange, or other short-term obligations of prime liquidity or other approved the securities;

- Discounting, rediscounting, purchasing or selling with or without its endorsement deals of exchange, checks, and other short-term obligations of prime liquidity;

- Buying and selling foreign exchange for its own account or for the account of central banks;

- Buying and selling negotiable securities other than shares for its own account or for the account of central banks;

- Discounting for central banks bills taken from their portfolio and rediscounting with central banks bills taken from its on portfolio;

- Opening and maintaining current or deposit accounts with central banks;

- Accepting deposits in connection with trustee agreements that may be made between the BIS and governments in connection with international settlements.

Organization and governance of the Bank for International Settlements

The bank currently employs 647 staff members from 54 countries. The three most important decision-making bodies within the bank are the general meeting of member’s central banks, the board of directors, and the management of the bank. The BIS currently has 60 members in the central banks, all of which are entitled to be represented and to vote in the general meetings. However, voting power is proportionate to the number of the BIS shares issued in the country of each member represented at the meeting.

At present, the board of directors of the bank has 19 members. The board has six ex officio directors, made up of the governors of the central banks of Belgium, France, Germany, Italy, and the United Kingdom and the chairman of the Board of Governors of the US Federal Reserve System. Each ex officio member may appoint another member of the same nationality. The rest of the board of directors is made up through the election of nine other governors from members of central banks. The governors of the central banks of Canada, China, Japan, Mexico, the Netherlands, Sweden, Switzerland, and the president of the European Central Bank are currently elected members of the board of directors.

The board of directors of the Bank for International Settlements is responsible for determining the strategies and policy directions for the bank, supervising the management, and fulfilling these specific tasks given by the bank´s statutes. The board meets six times a year.

Edward Jay Epstein explained the major beliefs of the inner circle of the BIS. The members of the board of directors have the firm belief that central banks should act with complete independence of their own governments. Another belief is that politicians should not be trusted to decide the fate of the international monetary system. The powerful central bankers of the world share a preference for pragmatism and flexibility over ideology. The most important belief is that they cannot allow a central bank of a large country to fail for fear that it could jeopardize the entire international monetary system due to interconnectedness with the central banks of other nations. This is a result of globalization and interdependence.

History professor Carroll Quigley from Georgetown University wrote a book entitled Tragedy and Hope: A History of the World in our Time (1966). This professor was a mentor of President Bill Clinton. Professor Quigley was very familiar with how the international bankers operated in the world. He agreed with their goals. Professor Quigley wrote the following: “I know of the operations of this network because I have studied it for 20 years and was permitted for two years, in the early 1960s to examine its papers and secret records. I have no aversion to it or to most of its aims and have, for much of my life, been close to it and too many of its instruments.”

Dr. Quigley described the international banking network in the following manner: “The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at frequent private meetings and conferences. The apex of the system was to be the Bank for International Settlements in Basel, Switzerland; a private bank owned and controlled by the world’s central banks which were themselves private corporations. The key to their success was that the international bankers would control and manipulate the money system of a nation while letting it appear to be controlled by the government.”

The founder of the most powerful banking dynasty in the world, Mayer Amschel Bauer, (who later adopted the name Rothschild), said in 1791, “allow me to issue and control a nation’s currency and I care not who makes its laws.” Four of his five sons were sent to London, Paris, Vienna, and Naples to establish a banking system that would be outside government control. The eldest son stayed at Frankfurt, Germany where the first Rothschild bank had been established. Eventually, a privately-owned central bank was established in almost every country, including the United States in 1913. These banking cartels have the authority to print money in their respective countries and governments must borrow money to pay their debts and fund their operations from them. And of course, at the top of this network is the privately-owned BIS, the central bank of the central banks of the world.

Ellen Brown wrote an article entitled “The Tower of Basel: Secretive Plans for the Issuing of a Global Currency” which was published in Global Research on April 17, 2013. The reporter explained that the British newspaper The London Telegraph had an article entitled “The G-20 Moves the World a Step Closer to a Global Currency.” The British newspaper said that the leaders of the G-20 nations have agreed to support a currency that was created by the International Monetary Fund called Special Drawing Rights or SDR.

The leaders of the G-20 nations have activated the power to create money and begin global quantitative easing, which is printing money out of thin air, not backed by gold or any other thing. The world is now a step closer to a global currency, backed by the global central banks, who are running the monetary policy for all humanity. The London Telegraph‘s article stated that the financial institution that would do this would be the BIS.

There is no doubt that the BIS is moving the entire world to regional currencies and ultimately, a global currency. The global currency could be a successor to the SDR, and may be the reason why the BIS recently adopted the SDR as its primary reserve currency. Canada, Mexico, and the United States are members of the trade group called the North American Free Trade Association (NAFTA). The Trump administration is presently reviewing the NAFTA agreement. Globalist Gary Cohen, former president of Goldman Sachs, is the head of the National Council on Economics in the White House. He has recommended to President Donald Trump not to withdraw from NAFTA. The president during the presidential campaign had promised to quit NATFA. Apparently that is a promise that he will not fulfill.

It may be that soon a common currency will be used for these three North American nations. It might be called the amero, which will sound like the euro, or some other name such as the NAFTA dollar. The adoption of the common currency is a voluntary surrender of sovereignty and is a step towards a one-world government dominated by these powerful international bankers.

After World War II, Jean Monnet, a French internationalist, who helped found the League of Nations, had the idea of creating a European Union where nations would relinquish their national sovereignty as an economic necessity. The BIS came up with the idea of creating the euro, which eventually was adopted by 17 European countries. The removal of the sovereignty of European nations was presented as an economic necessity, rather than as a profound political process. The powerful globalist elite made up of international bankers, powerful industrialists, and owners of media, with the complicity of government officials, decided to create a one-world government under the United Nations, but controlled by them. Thus, the European Union was born.

The officials and technocrats from the BIS were most instrumental in the creation of the European Union and its currency, the euro. They also created the very powerful European Central Bank, a bank that is not accountable to any government or to the European Parliament despite controlling the monetary policy of 17 countries.

The BIS has done very well financially over the years. In 2012, the supranational bank had 355 metric tons of gold and an estimated value of $19 billion. By the end of March 2012, the BIS made a profit of $1.17 billion. Each year the bank makes over $1 billion in profits. The bank makes much of its profits from the fees and commissions that it charges to central banks for its services.

On June 25, 2017, the BIS reported its balance sheet in its Annual Report. The BIS included a balance sheet total of Special Drawing Rights (SDR) of 242.2 billion (U.S. $329.0 billion) and on March 31, 2017, a net profit of SDR 827.6 million (U.S. $1.124 billion). Special Drawing Rights is a basket of the following currencies: U.S. dollar 41.73%, Euro 30.93%, Renminbi (Chinese yuan) 10.92%, Japanese yen 8.33%, British pound 8.09%

The relationship of the BIS with the International Monetary Fund and the World Bank

World Bank headquarters is in Washington, D.C.

The International Monetary Fund (IMF) lends money to national governments when these countries have some type of fiscal or monetary crisis. The IMF raises money by receiving contributions from its 184 member nations. Thus, all of its funds are taxpayer’s money. The World Bank also lends money and has 184 member nations. Within the World Bank are two separate institutions: The International Bank for Reconstruction and Development, which lends money to middle income and poor countries that have good credit, and the International Development Association, which lends money to the poorest countries of the world.

The BIS, as the central bank to the other central banks, facilitates the movement of money and provides what is known as “bridge loans” to central banks while waiting for the funds of the IMF and/or the World Bank. For example, when Brazil in 1998 had a currency crisis because it could not pay the enormous accumulated interest on loans made over a protracted period of time, the IMF, the World Bank, and the United States bailed out Brazil with a $41.5 billion package. If that nation had not paid its creditors, the United States banks such as Citigroup, J.P. Morgan Chase, and Fleet Boston, would have lost an enormous amount of money. Thus, the real winners of rescuing the largest country in South America were the U.S. banks that had made risky loans.

The Secretariat of the IMF’s new Financial Stability Board is located in Basel, Switzerland, and housed at the headquarters of the secretive Bank for International Settlements. The relationship between BIS and IMF is very close.

Criticisms of the Bank for International Settlements

Adam Lebor has made very strong criticisms of the BIS. He said that this bank is an elitist, opaque, and anti-democratic institution which is out of step with the 21st century. The legal immunities of the supranational bank perpetuate the belief that the central bankers are unaccountable to everyday citizens and their own governments. The bank does not reveal the discussions that take place at their meetings with the central bankers of the world or its internal operations. The bank has no accountability or transparency in its operation.

Lebor wrote that the BIS should lose its legal inviolability. It is important that citizens around the world demand more transparency and accountability from the financial institutions that have power over their lives and that includes the BIS. It is very important for Americans to pay attention to the operations of the BIS and the Federal Reserve Bank since America could very easily lose its sovereignty and be subjected to the desires and wishes of unelected and undemocratic central bankers of the world.