On February 9, President Donald Trump told a gathering of manufacturing CEOs at the White House he would release something in “two or three weeks” that would be “phenomenal in terms of tax.”

Almost eight months later, that tax plan is finally here — most of it, at least.

Trump and the “Big Six” group of Republican tax negotiators on Wednesday rolled out the most detailed look yet at the plan. It is the opening salvo of what is likely to be a long process to attempt to overhaul the tax code.

“Too many in our country are shut out of the dynamism of the US economy, which has led to the justifiable feeling that the system is rigged against hardworking Americans,” the nine-page plan reads. “With significant and meaningful tax reform and relief, we will create a fairer system that levels the playing field and extends economic opportunities to American workers, small businesses, and middle-income families.”

While Republican leaders and the White House want to complete the overhaul by the end of the year, Wall Street and political analysts think it’s likelier that a bill could pass by early 2018.

The Big Six has been meeting over the past few months to hash out the details of the tax plan. The group is Gary Cohn, the National Economic Council director; Steven Mnuchin, the Treasury secretary; Mitch McConnell, the Senate majority leader; Sen. Orrin Hatch, the Senate Finance Committee chairman; Paul Ryan, the House speaker; and Rep. Kevin Brady, the House Ways and Means Committee chairman.

“After years of work, we are moving forward with a unified framework that paves the way for bold, transformational tax reform — tax reform that will bring more jobs, fairer taxes, and bigger paychecks,” Brady said in a statement. “We have a lot of work ahead. But this moment marks a major step forward in the process.”

Key elements are still missing from the plan to avoid early pressure from industry groups and lobbyists.

Here’s what is in the initial version (the full text of the plan is at the bottom of this page):

Business tax changes:

- A 20% corporate tax rate. This is the first time Trump has publicly backed down from one of his earliest campaign promises: a 15% corporate tax rate. The budget math required for a 15% rate was too difficult, so the somewhat higher rate is the opening bid. The current statutory federal rate is 35%.

- A 25% rate for pass-through businesses. Instead of getting taxed at an individual rate for business profits, people who own their own business would pay at the pass-through rate. The plan also says it will consider rules to prevent “personal income” from being taxed at this rate. Mnuchin previously suggested there may be limitations on what types of businesses get this rate — it could apply only to goods producers and not service-oriented companies to prevent people from creating limited-liability corporations to store their assets and receive a lower rate.

- Elimination of some business deductions, industry-specific incentives, and more. There are few details, but the plan includes language regarding the “streamlining” of business tax breaks.

- A one-time repatriation tax. All overseas assets from US-owned companies would be considered repatriated and taxed at a one-time lower rate — this is designed to bring corporate profits back from overseas. Illiquid assets like real estate would be taxed at a lower rate than cash or cash equivalents, and the payments would be spread out over time. While there is no precise number in the plan, officials have indicated the rate could end up somewhere around 10%.

Personal tax changes:

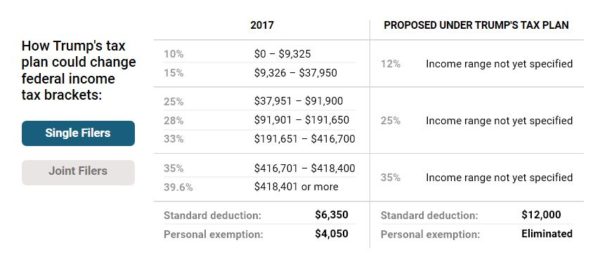

- A bottom individual tax rate of 12%. The plan specifies three tax brackets, with the lowest rate being 12%. That would represent a slight bump in the bottom bracket, which is now 10%. People currently in the 15% marginal tax bracket would most likely be included here.

- A middle tax bracket of 25%. The incomes in this bracket aren’t specified.

- The top individual tax rate of 35%. The current top rate is 39.6%.

- The possibility of a fourth, higher bracket. Because of Trump’s insistence that taxes for the wealthiest Americans not decrease, the plan proposes the possibility of a fourth tax bracket at a rate higher than 35% if the tax-writing committees wish. “An additional top rate may apply to the highest-income taxpayers to ensure that the reformed tax code is at least as progressive as the existing tax code and does not shift the tax burden from high-income to lower- and middle-income taxpayers,” the plan reads.

- A larger standard deduction. To avoid raising taxes on those currently in the 10% tax bracket, the standard deduction for all taxes would increase to $12,000 for individuals (up from $6,350) and $24,000 for married couples (up from $12,700). These are slightly less than the doubled deductions expected — and as Business Insider’s Josh Barro noted, the idea that this would save people money may be misleading.

- Eliminates most itemized deductions. The only deduction preserved explicitly in the plan is for charitable gifts and home-mortgage interest.

- Increases the size of the child tax credit. A pet project of Ivanka Trump, the proposal is to make the first $1,000 of the child tax credit refundable and increase the income level at which the credit would phase out.

- Vague promises on retirement savings and other deductions. Sections of the plan refer to retirement savings and other “provisions,” but details are sparse.

- Elimination of the state and local tax deduction. The so-called SALT deduction allows people to deduct what they pay in state and local taxes from their federal tax bill. Most of the people who take this deduction are wealthier Americans in Democratic states — about one-third of the beneficiaries are in New York, New Jersey, and California.

- Elimination of the estate tax. Called the “death tax” in the plan, this applies only to inherited assets totaling $5.49 million or more in 2017. Very few households pay the estate tax, but it has long been a target for Republicans.

Here’s a breakdown of what the new and old tax brackets could look like:

The Republican drive to pass a tax plan as soon as possible has intensified with the failure to repeal and replace the Affordable Care Act, the healthcare law also known as Obamacare. Going into the second year of Trump’s presidency and the start of the midterm election season with no major legislative victories could prove disastrous for the party.

The tax issue, while an imperative for the GOP, could be complicated by the continued desire to address healthcare.

Senate Republicans have planned to pass a tax-reform bill using budget reconciliation, which would allow it to pass with a simple majority, avoiding a Democratic filibuster. Some GOP members, however, have suggested combining another attempt at repealing Obamacare with the tax bill for 2018 reconciliation — making a difficult undertaking even more complicated.

From here, this outline of the tax plan will go to the two committees with jurisdiction over tax legislation — one in each chamber — to craft it into a workable bill.

Then Congress must pass a budget — with reconciliation instructions included.

Here’s the full text of the plan:

Republican Tax Plan by Jonathan Garber on Scribd

UNIFIED FRAMEWORK FOR FIXING OUR BROKEN TAX CODE

SEPTEMBER 27, 2017

OVERVIEW

It is now time for all members of Congress — Democrat, Republican and Independent — to support pro-American tax reform. It’s time for Congress to provide a level playing field for our workers, to bring American companies back home, to attract new companies and businesses to our country, and to put more money into the pockets of everyday hardworking people.

President Trump has laid out four principles for tax reform: First, make the tax code simple, fair and easy to understand. Second, give American workers a pay raise by allowing them to keep more of their hard-earned paychecks. Third, make America the jobs magnet of the world by leveling the playing field for American businesses and workers. Finally, bring back trillions of dollars that are currently kept offshore to reinvest in the American economy. Te President’s four principles are consistent with the goals of both congressional tax-writing committees, and are at the core of this framework for fixing America’s broken tax code. too many in our country are shut out of the dynamism of the U.S. economy, which has led to the justifiable feeling that the system is rigged against hardworking Americans. With significant and meaningful tax reform and relief, we will create a fairer system that levels the playing field and extends economic opportunities to American workers, small businesses, and middle-income families.The Trump Administration and Congress will work together to produce tax reform that will put America first.

GOALS

The Trump Administration, the House Committee on Ways and Means, and the Senate Committee on Finance have developed a unified framework to achieve pro-American, fiscally-responsible tax reform. This framework will deliver a 21st century tax code that is built for growth, supports middle-class families, defends our workers, protects our jobs, and puts America first. It will deliver fiscally responsible tax reform by broadening the tax base, closing loopholes and growing the economy. It includes:

Tax relief for middle-class families.

The simplicity of “postcard” tax filing for the vast majority of Americans.

Tax relief for businesses, especially small businesses.

Ending incentives to ship jobs, capital, and tax revenue overseas.

Broadening the tax base and providing greater fairness for all Americans by closing special interest tax breaks and loopholes.

This unified framework serves as a template for the tax-writing committees that will develop legislation through a transparent and inclusive committee process. Te committees will also develop additional reforms to improve the efficiency and effectiveness of tax laws and to effectuate the goals of the framework. The Chairmen welcome and encourage bipartisan support and participation in the process.

COMPETITIVENESS AND GROWTH FOR ALL JOB CREATORS

Special tax regimes exist to govern the tax treatment of certain industries and sectors. The framework will modernize these rules to ensure that the tax code better reflects economic reality and that such rules provide little opportunity for tax avoidance.