President Donald J. Trump, Vice President Mike Pence, Senate Majority Leader Mitch McConnell, House Speaker Paul Ryan, and other Congressional Republicans celebrate in the White House the passing of the Tax Cuts and Jobs Act.

On December 20, 2017, President Donald J. Trump, Vice President Mike Pence, Republican congressional leaders, and Republican members of the Senate and the House celebrated the passing of the Tax Cuts and Jobs Act at the White House. During a speech on the South Lawn of the White House, President Trump said the following: “We broke every record … It’s the largest tax cut in the history of our country. This is going to mean companies are going to be coming back. You know, I campaigned on the fact that, you know, we’re not going to lose our companies anymore. They have tremendous enthusiasm right now in this country and we have companies pouring back into our country.”

Shortly before President Trump and Republican lawmakers emerged from the White House to celebrate their legislative success, AT&T announced it would pay a $1,000 bonus to 200,000 of its employees and invest $1 billion in America as a result of the coming corporate tax cuts. Other large corporations followed. Comcast said it would give its employees $1,000 bonuses and Boeing said it would spend $300 million on its workers and in charity. These corporate announcements are evidence that the Republican tax plan would soon start delivering for workers.

The president said that the individual mandate repeal included in the Republicans’ tax legislation “essentially repealed ObamaCare because taxpayers will no longer face a penalty if they decline to purchase health insurance.” He added, “We are making America great again.” “You haven’t heard that, have you?, the president asked.”

House Speaker Paul Ryan congratulated President Trump’s “exquisite presidential leadership” for helping guide the tax reform bill through Congress over the past several months. “Mr. President, thank you for getting us over the finish line,” Speaker Ryan said.

Senate Majority Leader Mitch McConnell went through a large list of President Trump’s accomplishments before praising the president for his efforts to pass tax cuts and reform. Senator McConnell stated the following: “We’ve cemented the Supreme Court right of center for a generation. Mr. President, thanks to your nominees, we’ve put 12 circuit court judges in place. You’ve ended the overregulation of the American economy and that, coupled with what we did last night and what the House did this morning means America is going to start growing again. ”

Vice President Mike Pence, who worked arduously with his former colleagues in Congress, stated the following: “President Donald Trump is a man of his word. He’s a man of action and with the strong support of these members of Congress. President Donald Trump delivered a great victory for the American people. We made history today, but as the president said when we gathered this morning … we’re just getting started.”

White House officials have not yet signaled precisely when President Trump will sign the tax bill into law. White House Spokeswoman Sarah Huckabee Sanders said the president did not sign the bill at the event because there are still some technicalities that have to be ironed out. “This is not a signing event as the bill would still need to be enrolled and that will happen at a later date. We will keep you posted on details as they are confirmed,” she said.

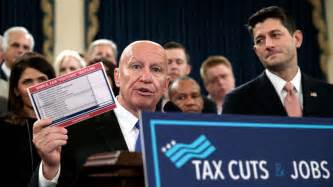

On December 19, 2017, Speaker of the House Paul Ryan, R-Wis, Kevin Brady, R-Tex, and other Republican representatives celebrate the passing of the bill Tax Cuts and Jobs Act.

House of Representatives approves biggest tax overhaul in 30 years

“Today, we give the people of this country their money back. This is their money, after all,” House Speaker Paul Ryan said shortly before the historic vote. With Treasury Secretary Steven Mnuchin and others watching from the gallery, the House passed the bill by a vote of 227-203, overcoming united opposition from Democrats and 12 Republicans who voted against it.

However, the House of Representatives had to vote on the bill a second time when the Senate parliamentarian pointed out that three of the minor provisions of the Bird Rule were violated. The Senate fixed the glitch and voted on December 20 on a party-line 51-48 vote after midnight and sent the bill to the House. The House of Representatives voted shortly after noon and passed the historic bill 224-201. The 12 GOP votes against the bill came from Republican representatives from the high-tax states of New York, New Jersey, and California. They did not like that the bill reduced the deductions from state and local taxes.

On December 20, 2017, Marisa Schultz and Bob Fredericks wrote an article titled “Congress sends GOP tax bill to Trump to sign” which was published in the New York Post. The reporters said a jubilant President Trump stated the following: “People are starting to see how great this historic victory was, the passage of the massive tax cuts and reform that’s — a lot of reform in there, but the tax cuts supersede and I said very specifically ‘use the word tax cuts’. It will be an incredible Christmas gift for hard-working Americans. I said I wanted to have it done before Christmas. We got it done.”

Earlier, President Trump took to twitter to once again criticize the Destroy Trump mainstream media for saying the reforms are a giveaway to the rich and big business. “The Tax Cuts are so large and so meaningful, and yet the Fake News is working overtime to follow the lead of their friends, the defeated Dems, and only demean. This is truly a case where the results will speak for themselves, starting very soon. Jobs, Jobs, Jobs!” tweeted the president.

The bill also allows oil drilling in Alaska’s Arctic National Wildlife Refuge which other presidents tried to do without success for over 40 years. Thanks to President Trump America will soon become an energy independent nation.

David Morgan and Amanda Becker wrote an article on Reuters on December 18, 2017, explaining that the House of Representatives approved the biggest overhaul of the American tax system in more than 30 years. The bill called the Tax Cuts and Jobs Act was sent to the Senate, where it was approved later in the evening.

Morgan and Becker wrote the following: “The plan includes steep tax cuts for corporations and wealthy taxpayers, as well as temporary tax cuts for some individuals and families. It repeals a section of the ObamaCare health system and allows oil drilling in Alaska’s Arctic National Wildlife Refuge, just two of many narrow changes added to the bill to secure sufficient to win its passage. Middle-income households would see an average tax cut of $900 next year, while the wealthiest 1% of Americans would see an average cut of $51,000, according to the nonpartisan Tax Policy Center, a think tank in Washington.”

President Donald Trump and Republicans in Congress believe that Tax Cuts and Jobs Act will improve the economy and job growth. They also see the legislation as key to retaining their majorities in the House and Senate in the November 2018 elections.

Democrats in the House of Representatives criticized the bill and their House Democratic Leader Nancy Pelosi said the following regarding the bill: “A Frankenstein monster riddled with carve-outs and loopholes that falls far short of the Republican promise of simplifying the tax code. This monster will come back to haunt them.”

Tax Cuts and Jobs Act

The Congress.gov website explained that the Tax Cuts and Jobs Act bill amends the Internal Revenue Code to reduce tax rates and modify policies, credits, and deductions for individuals and businesses. With respect to individuals, the bill does the following:

· Replaces the seven existing tax brackets (10%, 15%, 25%, 28%, 33%, 35%, and 39.6%) with four brackets (12%, 25%, 35%, and 39.6%).

· Increases the standard deduction.

· Repeals the deduction for personal exemptions.

· Establishes a 25% maximum rate on the business income of individuals.

· Increases the child tax credit and establishes a new family tax credit.

· Repeals the overall limitation on certain itemized deductions.

· Limits the mortgage interest deduction for debt incurred after November 2, 2017, to mortgages of up to $500,000 (currently $1 million).

· Repeals the deduction for state and local income or sales taxes not paid or accrued in a trade or business.

· Repeals the deduction for medical expenses.

· Consolidates and repeals several education-related deductions and credits.

· Repeals the alternative minimum tax, and the estate and generation-skipping transfer taxes in six years.

With respect to businesses, the bill reduces the corporate tax rate from a maximum of 35% to a flat 20% rate (25% for personal services corporations). And also does the following:

· Allows increased expensing of the costs of certain property.

· Limits the deductibility of net interest expenses to 30% of the business’s adjusted taxable income.

· Repeals the work opportunity tax credit.

· Terminates the exclusion for interest on private activity bonds.

· Modifies or repeals various energy-related deductions and credits the taxation of foreign income, and imposes an excise tax on certain payments from domestic corporations to related foreign corporations.

Conclusion

Not a single Democrat in the House and the Senate voted for the bill. Senate and House Democratic leaders and others slammed the bill. This writer hopes that when Americans see the improvement of the economy, the creation of tens of thousands new and better paid jobs, corporations giving raises and bonuses to their employees, and more money in their pockets, they will remember that not one Democrat supported the Tax Cuts and Jobs Act. The Democrats need to be held accountable in future elections.

President Donald Trump and Republicans in Congress have achieved an enormous victory for the American people. For more than 30 years, the tax code had not been reformed. President Trump fulfilled one of his major promises during his campaign by lowering taxes for individuals, small businesses and large corporations.

The Tax Cuts and Jobs Act will improve the economy and job growth. Multinational corporations will be able to better compete in the world and their trillions abroad will now be able to return to America.