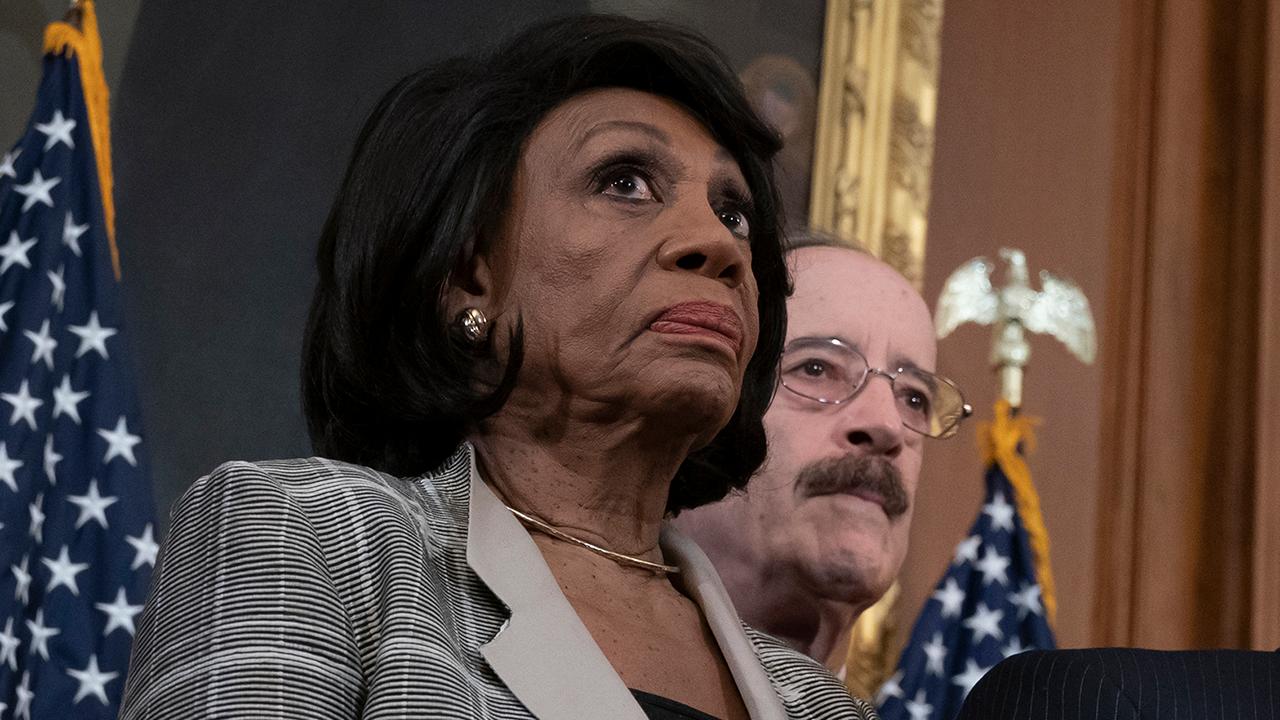

House Democrats are proposing that all banks and credit unions receive a new “diversity and inclusion” rating in an unprecedented step that would fundamentally alter federal regulators’ critical “CAMELS” rating system that currently employs a series of metrics that solely assess the financial health of banking institutions.The “Promoting Diversity and Inclusion in Banking Act of 2019″ is draft legislation supported by Democrats on the House Subcommittee on Diversity and Inclusion, which was created by House Financial Services Committee chairwoman Maxine Waters Rep. Maxine Waters, D-Calif. Waters has long pushed for government-led diversity efforts, even as Republicans have challenged her knowledge of fundamental economic issues.”We need to change it and we need to change it right away. The excuse that we can’t find any, that’s what I’m hearing from some of you, that’s not acceptable,” Rep. Al Green, D-Texas, said at a Wednesday hearing held by the subcommittee. “When you have power, you have to use it. We have the power. Regulations may be the thing to do. I think the carrot was a good idea, but after having heard some things today, I think we have to move to the stick, that’s regulations.””When you have power, you have to use it. We have the power.”— Rep. Al Green, D-TexasThe CAMELS system, known as the Uniform Financial Institutions Rating System, assesses banks’ (c)apital adequacy; (a)ssets; (m)anagement capability; (e)arnings; (l)iquidity; and (s)ensitivity to market risk, each on a scale of 1 to 5.READ DEMS’ BILL THAT WOULD ADD ‘DIVERSITY’ SCORE FOR ALL BANKSAll of those categories involve financial information, and the CAMELS rating is then used by federal authorities that oversee and regulate banks; a failing CAMELS score is considered so significant that it is ordinarily hidden from public view to avoid a run on the bank involved.But, the new bill proposes to amend the Dodd-Frank Wall Street Reform and Consumer Protection Act so that the CAMELS system adds an additional diversity category for the “Board of Governors, the Comptroller of the Currency, the Corporation, and the National Credit Union” to analyze.Specifically, the new category looks at whether depository institutions have policies to “encourage diversity and inclusion” in hiring practices; whether they train employees on diversity and inclusion; and whether they have a “Diversity and Inclusion officer” who reports to the CEO.Any “equivalent rating by any such agency under a comparable rating system” should also have a diversity score, the bill states.The proposal isn’t the first similar bill to be considered by Waters’ subcommittee on diversity. Last June, the panel met in a hearing entitled, “Diverse Asset Managers: Challenges, Solutions and Opportunities for Inclusion,” and released a draft of a bill called the ‘‘Diverse Asset Managers Act.” A draft of the legislation stated that “conscious efforts to facilitate diverse and inclusive asset management firm selection are required to overcome obstacles facing diverse individual-owned and controlled asset management firms.”READ DEMS’ ‘DIVERSE ASSET MANAGERS ACT’ BILLThe law would mandate that asset management firms publish a request for services in “print and online publications oriented towards women, minorities, and veterans,” to consider at least one of these firms that submits a proposal, and if one of these firms submits a proposal that “satisfies the criteria set forth in request for proposal, to invite at least one such diverse individual-owned and controlled asset management firm to present their proposal to the person.”Each firm also would need to report to the government on their efforts to hire minority-owned asset management firms.The bills stand little passage of becoming law given the current composition of the House and Senate, but Democratic leaders have left little doubt that they would pursue the measures should the composition of Congress change. Speaking in June 2018, Waters underscored her commitment to diversity by seemingly suggesting that her efforts to help the technology sector were conditioned on diversity programs there.“I have a question that I would like to propose,” Waters began. “But before I do that, since you mentioned Silicon Valley, I too, was there recently. I was appalled at the lack of diversity. I know that there are a number of organizations, civil rights organizations that have been working very hard to increase participation of minorities and women in the Silicon Valley businesses.”CLICK HERE TO GET THE FOX NEWS APPWaters added: “They have not done very well, and of course I would be anxious to be of assistance to them in making sure that we could reduce the costs and reduce the hassle of becoming IPOs. But we certainly must take into consideration whether or not these companies are developing, understanding that some of us are going to be focused on diversity in those companies.”Democrats’ efforts appeared to be yielding results. In January, Goldman Sachs Group Inc. Chief Executive Officer David Solomon declared that Goldman “will no longer take a company public in the U.S. and Europe if it lacks a director who is either female or diverse.”Fox News’ “Tucker Carlson Tonight” investigative producer Alex Pfeiffer contributed to this report.

Read More

Fox News

Fox News

House Dems push legislation requiring banks to receive critical ‘diversity and inclusion’ rating

February 14, 2020 by