As part of the $1.9 trillion relief package, Congress is slated to set aside $350 billion to state and local governments. While the pandemic has crippled the economy, it turns out most states are actually running budget surpluses and some states haven’t even finished using money from the CARES act, leaving taxpayers to wonder why Congress is shelling out billions to these states.

Congress extended the deadline to spend $150 billion worth of aide that was given to states from the Cares Act in March after states and localities said they didn’t have enough time to spend the much needed money, according to Bloomberg.

A coalition of attorney generals from 43 states, Washington D.C. and five U.S. territories sent a letter in November to Congressional leaders urging them to extend the deadline to at least Dec. 31, 2021. The group said that by extending the deadline, communities could “be more strategic with the use of CARES Act funds.”

Iowa received $1.25 billion from the CARES act, according to the Treasury Department. But as of February 25, the state still has about $174 million left to spend, although some of the funds have been allocated, according to Iowa’s coronavirus relief summary.(RELATED: Billions Of Dollars Of Coronavirus Stimulus Still Hasn’t Been Spent, Republican Senators Say In Letter To Biden)

States, which each received a minimum of $1.25 billion in relief but were sometimes given more depending on population, are not allowed to use money from the CARES Act to close up budget holes. Some states have faced increased costs for other expenses related to the pandemic and so they’re depending on another round of stimulus, according to Bloomberg. States like Alaska and Montana, however, who have had low COVID-19 cases have struggled to spend their money and they can’t shift the funds, according to Michigan Radio.

The pandemic hasn’t had as severe of an impact as originally anticipated, according to data.

Revenues for fiscal year 2020, which ended in June, were only 2% below states’ pre-pandemic predictions, according to the Center on Budget and Policy Priorities (CBPP). Local governments, while also facing shortfalls, haven’t been hit as hard as statewide budgets because they rely heavily on property taxes, according to the CBPP.

CBPP estimates that without additional federal funds, states shortfalls through the 2022 fiscal year will total roughly $305 billion while local losses will total about $135 billion through fiscal year 2022.

Total tax revenue collected across all 50 states was down 1.8% from March through December compared to the same period in 2019, according to Bloomberg Tax.

Aside from a handful of states, most states are actually posting budget surpluses.

A new report from Wirepoints found that 38 states are actually running surpluses for the 2020 and 2021 fiscal years when coronavirus relief and budget reserves are tacked on. The 38 states combined had a revenue surplus totaling $71 billion, according to the report.

For example, Tennessee officials reported that the state exceeded their tax revenue estimates in January by a whopping $380 million, according to the Associated Press. The total is nearly 8% higher than revenues received in January of 2020, according to the report.

“At this time, the economic growth we have experienced in these first six months puts the state in a good fiscal position to fund the current and upcoming fiscal year budgets,” Department of Finance and Administration Commissioner Butch Eley said, according to the AP.

An analysis of state budgets from JPMorgan found that in 2020, average falls in revenue were just .12% compared to 2019. In fact, 21 out of the 47 states analyzed showed positive year over year growth on tax receipts, according to the analysis.

In California, a state hit hard by the coronavirus, Democratic Gov. Gavin Newsom unveiled a $227 billion spending plan, including a one-time $15 billion surplus, according to The Times Herald.

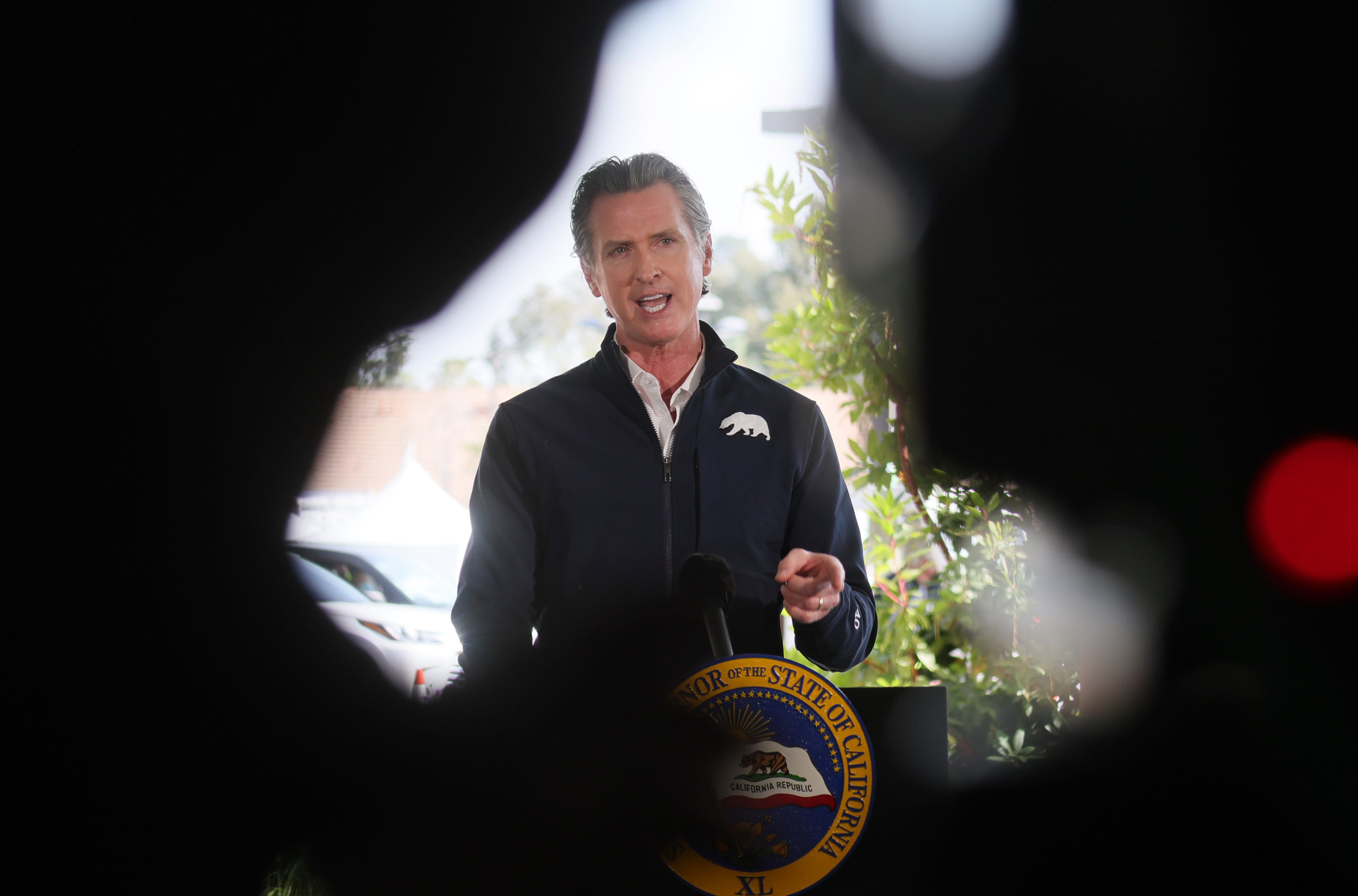

LOS ANGELES, CALIFORNIA – FEBRUARY 16: California Governor Gavin Newsom speaks at a press conference following the opening of a new large scale COVID-19 vaccination site at Cal State Los Angeles on February 16, 2021 in Los Angeles, California.(Mario Tama/Getty Images)

Newsom predicted that the state’s reserves will actually increase by $22 billion which would cover future deficits, according to the report. Part of the reason California has fared rather well is because its higher-income residents profited off the sales of stocks, lands or businesses which resulted in $18.5 billion in tax revenue for the state, according to the report.

The first three quarters of 2020 actually saw higher tax revenues in ten states compared to 2019, with Idaho seeing a 12.2% increase and Illinois seeing a 7.8% increase, according to the Tax Foundation. Of course some states didn’t fare as well, with states that rely heavily not he energy sector, like Connecticut, Hawaii and Washington struggling the most, according to the report.

Budgets could become tighter should the pandemic effects’ continue.

This post originally appeared on and written by:

Brianna Lyman

The Daily Caller 2021-02-25 23:36:00