(Above picture from 2010 when Democrats voted for the largest tax increase in US history – Obamacare.) Democrats are at it again. On November 16, 2017, the US House voted on the tax cut and jobs act. 227 Republicans voted for tax cuts for working Americans. 0 Democrats voted for tax cuts for working Americans. […]

FINAL TALLY: 664 Democrat Votes AGAINST Middle Class Tax Cuts – ZERO Dem Votes for Tax Cuts.

The Economic Impact of the Tax Cuts and Jobs Act

The Tax Cuts and Jobs Act, which is expected to be signed into law today, would reform the tax code by lowering federal marginal rates for most households, corporations, and small businesses. We have revised our previous estimates of the House and Senate versions of the bill to reflect changes made by the conference committee. […]

BREAKING: Senate Passes Sweeping Tax Reform, Trump Poised to Sign Historic Bill Into Law.

It’s (nearly) over. By a 51-48, strictly along party lines, the US Senate has passed a GOP-backed tax reform package that will cut taxes for more than 80 percent of all Americans (raising taxes on a tiny, disproportionately wealthy fraction), benefit small businesses, and make America’s extraordinarily high corporate tax rate — both statutory and […]

Senate debates tax reform bill after House passage, but last-minute hiccups arise.

House approves tax reform bill, as Trump eyes major legislative win The House on Tuesday approved a massive tax overhaul that would usher in steep rate cuts for American companies, double the deduction millions of families claim on their annual returns and make a host of other changes as part of the biggest rewrite of […]

Analysis: With Final Passage Likely, Tax Reform Delivers Conservative Policy Victories and Dishonest Liberal Hysteria.

In short, it’s happening. Congress’ bicameral conference committee unveiled a compromise tax reform bill on Friday, with votes in each chamber expected this week. The procedural rules forbid any further amendments, changes or “tweaks” to the now-finalized legislation; the next and last legislative step is a pair of up-or-down votes on an identical bill in […]

Trump’s Christmas Gift to the Middle Class.

President Donald J. Trump announced his Christmas gift to middle class on Saturday – the GOP tax reform bill that is expected to pass on Tuesday. Late Friday night, the GOP announced their final version of the bill. More Townhall coverage on the specifics in the bill will come tomorrow and on Monday. But for […]

The Text Of The Final GOP Tax Bill Is Finally Here. Here Are The Important Points.

Republicans unveiled the final version of the Tax Cuts and Jobs Act early Friday evening, paving the way for their first major legislative win of the 115th Congress. GOP lawmakers are expected to pass legislation providing the largest overhaul of the U.S. tax code in 31 years before the end of next week. The $1.5 […]

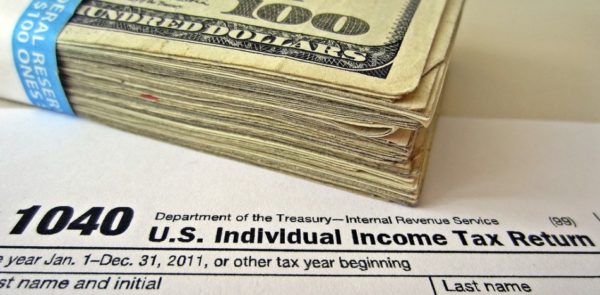

How Much Will Tax Reform Really Affect the American Family?

Liberals and most media publications have been quick to jump on the new tax reform plan, criticizing it for being bad for the middle class, or putting pressure on the American family. But what effects will the new tax plan really have on the American family? Are there going to be major changes, or have […]

Trump’s Final Tax Reform Pitch.

President Donald Trump made his final push for tax reform Wednesday afternoon from the White House surrounded by middle class families. “As a candidate, I promised we would pass a massive tax cut for the everyday, working American families who are the backbone and the heartbeat of our country. Now we’re just days away from […]

Negotiators strike deal in principle on tax bill

Senate and House Republicans have struck an “agreement in principle” on a sweeping tax-cut bill that if passed would be the first major piece of legislation signed by President Trump. Senate Finance Committee Chairman Orrin Hatch (R-Utah) told reporters about noon Wednesday of the deal between Senate and House negotiators on taxes. “We’re going to talk to […]

Tax Plan Is a Cut for Everyone.

Whenever I’m asked if the Trump tax cut is for the rich, I say yes. It is a tax cut for the rich. It is a tax cut for the middle class. It is a tax cut for small businesses. It is a tax cut for the Fortune 100. If you pay federal income taxes, […]

It’s Official! Senate Passes Trump Tax Cuts! President Gives Americans Greatest Christmas Present in Decades!

After months of work and last minute alterations, the US Senate passed President Trump’s tax cuts in a vote of 51 – 49. No Democrats voted for the bill. President Trump noted earlier this week, Democrats only want to increase taxes on working Americans. From the Oval Office, the President stated that Democrats only want tax […]

Senate passes tax overhaul, securing major GOP victory.

The Senate passed legislation to overhaul the tax code early Saturday morning, handing Republicans a badly needed legislative and political victory. Senators voted 51-49 to pass the plan, capping off days of debate and hand wringing as leadership worked frantically behind the scenes to win over holdouts and get the proposal in line with the chamber’s rules. Republican […]

Why Income Taxes Are Immoral.

In our Jeffersonian conception of government, governments exist to secure our rights. Thus, we allow government the power to tax us to pay for the costs of protecting our rights and to have an orderly society. (Flickr) Nearly 2,500 years ago, Plato argued that poets, “with their words and phrases” were too dangerous and could […]

Don’t Believe the Democrat Attacks on Tax Reform. Here Are the Facts.

As president of the State Financial Officers Foundation, I have the privilege of working with some of the nation’s sharpest financial officers. They are not merely treasurers. They are thought leaders, experts, and fighters who, day-in and day-out, serve on the front lines of fiscal policy and intimately understand their state budgets, cash flow, and […]

How the GOP Tax Bill Will Affect the Economy.

The House passed its version of the Tax Cuts and Jobs Act on Thursday, a bill that would reform the tax code by lowering marginal rates for most households, corporations, and small businesses. The Senate is also working on its own version of the bill. Though the complete details are yet to be finalized, both […]

NY Times Pushes Case for No Tax Cuts At All

Not everyone is crazy about the current tax reform proposals before Congress. Some want more pro-growth measures. Others want it benefits geared more toward middle- and low-income people. But a piece in the New York Times argues Congress should not pursue tax cuts at all. If anything, the piece calls for even higher taxes … […]

House passes sweeping tax bill in huge victory for GOP.

The House on Thursday passed legislation to overhaul the tax code, moving Republicans one step closer to achieving the top item on their legislative agenda. The measure was approved by a vote of 227-205. No Democrats voted for the bill, while 13 Republicans broke ranks to oppose it. “Passing this bill is the single biggest […]

Tax bills give small businesses plenty to be thankful for.

Small-business owners have a lot to be thankful for next week. The recently introduced tax-reform bills in the House of Representatives and Senate make small-business tax cuts a centerpiece. This long overdue relief would finally address the overtaxation that most small business owners say is the biggest hurdle they face. At the moment, small businesses, […]

Republicans Move To Scrap Obamacare Individual Mandate In Tax Reform Bill

The Republican Senate is now moving to include repeal of the Obamacare individual mandate in their tax reform bill. That move is largely designed to quell conservative complaints about the Senate bill, which is weaker than the House version of the same bill: it delays corporate tax cuts, and retains the estate tax; pass-through businesses […]

More Winning: Latest Senate Tax Bill Raises Child Tax Credit, Ends Obamacare Individual Mandate.

The Senate Finance Committee released its updated tax bill late Tuesday night, and there’s a lot to cheer populist conservatives. The new bill raises the child tax credit to $2000, twice the current credit of $1000 per child. The earlier version of the Senate bill raised it to $1,650. A higher child tax credit is one […]

Republicans Confident They Have Needed Votes for Tax Reform

On Sunday, several prominent Republicans reassured voters that President Donald J. Trump’s tax reform plan has the necessary votes to pass through Congress, reports the Washington Examiner. Today, on Fox and Friends, House Majority Whip Steve Scalise (R-LA) discussed his confidence that the majority of the Freedom Caucus would support President Trump’s tax reform, more […]

House Republican Tax Summary Released. Read The Details Here

The Wall Street Journal has reviewed a detailed summary of the soon-to-be unveiled House Republican tax plan. “House Republicans, seeking the biggest transformation of the U.S. tax code in more than 30 years, aim to permanently chop the corporate tax rate from 35% to 20%, compress the number of individual income tax brackets, and repeal […]

Small Business Owner in Trump Country Explains Why Tax Reform Will Help the 99%

SEDALIA, Mo.—As Republicans prepare to unveil the details of their major tax reform proposal this week, a small business owner in America’s heartland is speaking out about how her and her employees could benefit. “The 1 percent that keeps being talked about, I want them to talk about the other 99 percent, and they don’t […]

House Passes Senate Budget, Moves One Step Closer To Tax Reform

The House narrowly passed the Senate’s fiscal year 2018 budget equipped with reconciliation instructions for tax reform in a 216-212 vote Thursday. Passing the measure brings Republicans one step closer to their plans to overhaul the tax code. The bill, which allows for $1.5 trillion in deficit spending, provides the GOP with the tools needed to […]

Senate Budget a Major Step Toward Tax Reform, but Falls Short on Spending Reforms

The Senate passed its fiscal year 2018 budget resolution late Thursday night, paving the way for potentially the most comprehensive tax reform package in decades. The proposal is a significant step toward implementing the president and Congress’ tax reform agenda. However, it fails to make significant cuts to federal spending—an important piece of the puzzle […]

Millennials LOVE Bernie’s Tax Plan…Until They’re Told It’s Trump’s

President Donald Trump’s tax plan seems to really resonate with millennials, but only when presented as if it were a proposal from Sen. Bernie Sanders of Vermont. Campus Reform asked a number of students at George Washington University if they supported some of the features of Trump’s tax plan, but sold the provisions as key […]

Senate narrowly passes 2018 budget, paving way for tax reform

Senate Republicans took the first step Thursday evening toward passing a tax plan and fulfilling a long-held campaign pledge. Senators narrowly voted 51-49 to pass the fiscal 2018 budget after a grueling hours-long marathon on the Senate floor. Sen. Rand Paul (R-Ky.) joined with every Democrat and independent to vote against the bill. The spending […]