Arkansas Sen. Tom Cotton, R., took a jab at the Biden economy during “Sunday Morning Futures,” alleging policies implemented under the current administration are to blame for the infamous collapse of Silicon Valley Bank that left markets scrambling earlier this month. “The failure of Silicon Valley Bank and the stress it’s put on our banking […]

Tom Cotton blasts Biden over SVB bailout, economic turmoil that created collapse: His ‘failures all the way’

SVB Exec Joseph Gentile Served as CFO to Lehman Brothers Before 2008 Collapse

Before joining the Silicon Valley Bank (SVB) as the Chief Administrative Officer (CAO) in 2007, Joseph Gentile served as the Chief Financial Officer (CFO) at Lehman Brothers’ Global Investment Bank before the public collapse in 2008. Gentile worked at Lehman as the CFO, directing the accounting and financial needs in the Fixed Income division before he left in 2007 — just one year

Dem Rep. Harder: ‘Genie Is out’ after SVB and We’ll Need to Raise Amount of Deposits Protected ‘Pretty Dramatically’ Above $250K

On Wednesday’s broadcast of NBC’s “MTP Daily,” Rep. Josh Harder (D-CA) argued that covering deposits above the $250,000 limit in the case of Silicon Valley Bank (SVB) means “the genie is out of the bottle” and the limit on deposits covered by the FDIC has “implicitly been raised, but we need to make it explicit”

Waters: SVB Depositors Deserved Help, But Maybe Those Who Say They ‘Got Special Treatment Have Some Arguments’

On Wednesday’s broadcast of MSNBC’s “All In,” House Financial Services Committee Ranking Member Rep. Maxine Waters (D-CA) stated that while the uninsured depositors at Silicon Valley Bank deserved to be helped, maybe those “who are thinking that they got special treatment have some arguments too.” Host Chris Hayes asked, “I want to ask you a

Khanna: Some SVB Depositors Had ‘Financially Irresponsible’ Deposits There

On Thursday’s “Hugh Hewitt Show,” Rep. Ro Khanna (D-CA) stated that there were some companies who had deposits in Silicon Valley Bank (SVB) that were “malpractice” and “financially irresponsible.” Khanna said SVB depositors should have been protected and some of them were “leading in AI and defense tech. If you care — if people care

Israeli Banks Transferred $1 Billion Out of SVB Before Collapse

According to a report by the Times of Israel, the country’s two largest banks were able to transfer $1 billion out of Silicon Valley Bank to accounts in Israel before it was seized by the feds. Silicon Valley Bank (SVB), the 16th largest bank in the United States at the time of its failure late […]

Biden Claims U.S. Banking System Is ‘Safe’ After SVB Collapse

Joe Biden sought to reassure the public about the the health of the U.S. banking system on Monday, following the stunning downfalls of Silicon Valley Bank and Signature Bank. “Americans can rest assured that our banking system is safe,” Biden said in a statement at the White House. “Your deposits are safe. Let me also

Pinkerton: Green, Woke, and Now Broke — How SVB Became the 2nd Biggest Bank Failure in U.S. History

Go Woke, Go Bust Oh so woke, oh so green, oh so diverse Silicon Valley Bank (SVB) just went bust. One can go to its website—still up for who knows how much longer—and see that it claims assets of $212 billion. But as they say, the bigger they are, the harder they fall; and SVB makes

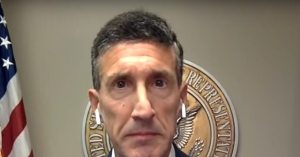

GOP Rep. Kustoff: We Need to Know Why Regulators ‘Failed to Catch’ SVB Collapse

On Saturday’s broadcast of the Fox News Channel’s “Fox News Live,” Rep. David Kustoff (R-TN) stated that while Silicon Valley Bank (SVB) was poorly managed and had unique issues, we must consider that the collapse could be a partial reflection of “the general state of the economy,” and said that “We need to also know