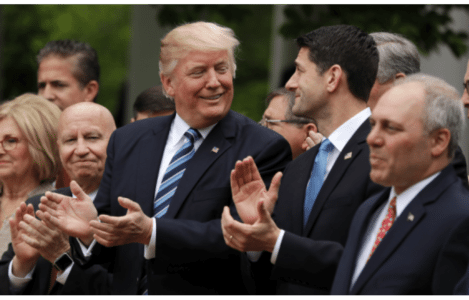

Yesterday House Republicans gave an Obamacare repeal a second try following their failure in March. In March the “American Health Care Act” (AHCA) was dead on arrival, without as much as a vote being held. This time around, the revised AHCA (previously branded “Obamacare-lite”) passed in the House 217/213, with 217 Republicans voting in favor, 20 against (and 1 abstaining), while all 193 Democrats voted against the bill.

Outside of some fear-mongering over people losing coverage, there hasn’t been much discussion about what the contents of the bill actually are. As you’d guess from how the vote was split, there was nothing of redeeming value for Democrats – and even some Republicans wouldn’t back the bill (you can find a list and their explanations for doing so here).

As for the details, here’s a key summary, courtesy of Unbiased America.

Parts of Obamacare repealed:

• The employer mandate and penalties for not insuring employees who work more than 30 hours a week at companies with more than 50 employees are repealed.

• The individual mandate and penalties for not having insurance are repealed.

• Obamacare’s expansion of Medicaid will effectively be reversed in 2020 when the federal government stops funding it. States that have not already expanded would not be allowed to do so, starting immediately.

• Obamacare’s income-based subsidies are ended.

• The 3.8 percent tax on investment income is repealed, as is the 0.9 percent tax on higher income Americans.

• The tax on medical devices is eliminated, as are the taxes on prescription medications, health insurance premiums, flexible spending accounts, tanning salons, and retiree prescription drug coverage.

• The tax deduction on expenses exceeding 7.5 percent of a family’s income is reinstated (Obamacare had increased the threshold to 10 percent).

• Obamacare’s prohibition on using Flexible Spending Account and Health Savings Account (HSA) pre-tax dollars to purchase non-prescription, over-the-counter medicines is repealed.

• The tax penalty on withdrawing money from Health Savings Account for non-qualified medical expenses is repealed.

• State Medicaid plans will no longer have to cover some Obamacare-mandated essential health benefits.

• Planned Parenthood funding is eliminated.

Parts of Obamacare kept:

• People with preexisting conditions cannot be denied coverage. The measure would provide states with federal funds to help set up high-risk pools to provide insurance to the sickest patients and to help those with pre-existing conditions pay for insurance.

• Dependents can still stay on their parent’s health insurance plan until age 26.

• Insurers are still prohibited from setting annual and lifetime limits on individual coverage.

• The “Cadillac tax” on generous healthcare plans will remain, but be postponed from 2020 to 2025.

• Current Medicaid enrollees will be grandfathered in when the federal government stops providing the extra federal funds that allow for expansion in 2020.

Parts of Obamacare replaced:

• Obamacare’s income-based subsidies are replaced by age-based tax credits of $2,000 to $4,000 per person per year, increasing with someone’s age. The credits would start to phase out for individuals earning $75,000 and households earning $150,000, and would be unavailable for individuals who earn more than $215,000.

• Although the annual penalty for not having insurance is repealed, people who wait until they become sick or let their coverage lapse for more than 63 days can be charged a 30 percent surcharge on premiums for one year when they do finally sign up.

• The amount people and employers can contribute to tax-free health savings accounts will double.

• Private plans are still required to offer ten essential health benefits, but states can now opt out of the requirement.

• States will now be able to opt out of Obamacare’s mandate that insurers charge the same rates to sick and healthy people.

• Under Obamacare, insurers could only charge seniors up to 3 times more than they charged young people. The new law changes that restriction to 5 times more.

In summary, the heart of Obamacare, the individual mandate, is torn out, as are the major taxes funding the law. The main argument against the repeal, that those with preexisting conditions will lose care is bogus, as the ACHA actually does more to insure those with preexisting conditions.

Will it be viable? The Senate is waiting until the CBO scores the bill (calculates the cost) before voting on it. Senate Republicans currently hold a slight 52-48 majority, but are eyeing special rules to pass a version of the ACHA with only a simple majority.

Source: Allen West